Source: Shamubeel Eaqub, StatsNZ and RBNZ

This story was first published on Oct 14, 2024 and was one of the most-read columns I have published on Just the Business.

Since it was published, we’ve had confirmation that inflation is back within the Reserve Bank’s target range at 2.2% in both calendar year 2024 and the year ended September, while GDP fell 1.0% in the September quarter, making it the worst recession since 1991.

In per capita terms, GDP fell 1.2% in the September quarter and was down 2.1% in the year ended September.

This column is free to all so you’re welcome to forward it to anybody you think may be interested. I intend to republish some more of the most popular columns from 2024 through January, interspersed with the occasional new column, before resuming my normal two columns a week schedule in February.

An economy in a hole

On Wednesday we should get inflation data showing that the Consumers Price Index has at last fallen back into the Reserve Bank's 1% to 3% target range.

I've seen two banks providing a 2.2% forecast and three saying 2.3% for the year ended September, compared with 3.3% for the year ended June, and the RBNZ is also forecasting a 2.3% outcome making it 13 quarters that RBNZ failed in its primary job of keeping inflation contained.

The reason it will fall so much is because the September quarter of last year, which rose 1.8%, will drop out of the annual calculation.

But getting the inflation Genie back in the bottle – the CPI peaked at 7.3% in the year ended June 2022 – has come at great cost to the economy.

Data out yesterday showed the Performance of Services Index for September continued in contractionary territory for a seventh consecutive month.

The Performance of Manufacturing Index is in even worse shape, having contracted in each of the 19 months ended September.

We're regularly getting news of businesses shutting their doors, such as Wellington cafe chains Pandoro and Bordeaux Bakery, Winstone Pulp International closing two of its North Island mills and Alliance Group closing its Smithfield meat processing plant in Timaru.

Worse than the GFC

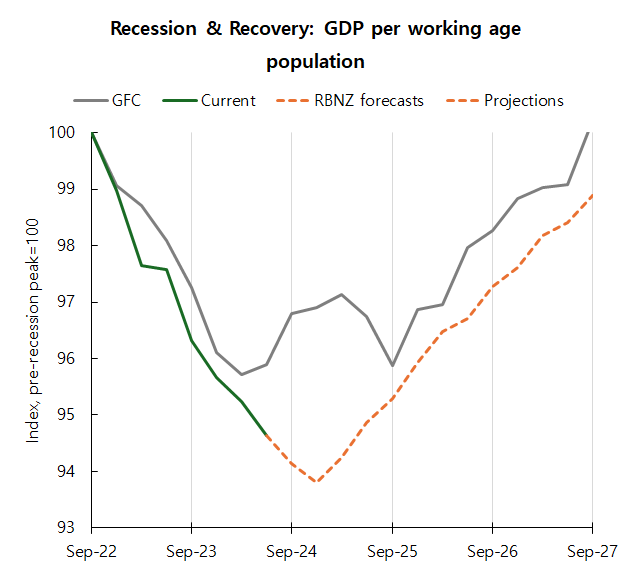

Economist Shamubeel Eaqub says the economy has essentially been in recession since September 2022 on a per-capita basis and RBNZ forecasts don't have us starting to climb out of it until the December quarter of this year.

“RBNZ's forecasts suggest there is more pain to come until the end of 2024 and that the recovery will be slow – we will not get back to pre-recession levels until maybe the end of 2028,” Eaqub wrote on LinkedIn.

“This is much worse than the GFC. At the human level, this means more job losses and more business closures.”

Eaqub notes the “massive increase in KiwiSaver hardship withdrawals,” adding that recessions are very hard on some people.

But the word “recession” doesn't appear at all in RBNZ's latest annual report and nor did it appear in the 2022/23 report.

The New Zealand Initiative's Eric Crampton has been keeping tally and found there's been a marked decline in mention of the word “inflation” in RBNZ annual reports since Adrian Orr became RBNZ governor.

This year there were 33 mentions of inflation or inflationary, six of which were in relation to inflation-indexed government bonds, but that was down from 42 mentions in last year's report.

In the 2016/17 annual report, there were 88 mentions of the word inflation, up from 60 the previous year.

When RBNZ couldn't get inflation to 2%

And remember, RBNZ had the opposite problem and was then struggling to get our very low inflation rate up anywhere near the middle of its target range.

Only two of this year's mentions acknowledged that inflation had been outside RBNZ's target and only then in the context that it was about to return to the target range.

By contrast, after zero mentions of the word “climate” in any of the 2015/16, 2016/17 and 2017/18 annual reports, it appeared 39 times in this year’s reports, although that was down from 60 mentions last year and 58 in 2021/22.

There's a certain gallows humour in reading RBNZ's “Statement of Performance” which says that “we monitor and assess the MPC (monetary policy committee) against the remit, charter and code of conduct with a formal review on an annual basis” and that RBNZ gives itself an “achieved” mark for both the latest year and the previous year, even though the MPC manifestly did not achieve its target in either year.

“The board successfully exercised its statutory duty to monitor and perform its annual assessment of the performance of the MPC and its members in discharging their responsibilities,” the report says.

“During 2023/24, no issues were identified and all MPC members certified that they had complied with their procedural responsibilities, including their responsibility to act consistently with the remit, charter and code of conduct. Therefore this measure was observed as achieved.”

Just bizarre

Again, given RBNZ and the MPC's singular failure to achieve their primary task of keeping inflation contained, the idea that they can be judged to have “achieved” anything is just bizarre.

Last year, I was repulsed by Orr including the words: “Great team, best central bank” in his contribution to the report, but I guess I'm getting used to his through-the-looking-glass rhetoric because I barely reacted to his repeating those words in this year's report.

The NZ Initiative's executive director, Oliver Hartwich notes these same back-slapping words of self praise and says the report ignores “the serious macroeconomic mismanagement by the current leadership.”

What Hartwich is referring to is the fact that creating out-of-control inflation can be laid squarely at RBNZ's feet because it continued to print money long after it became apparent that the economy had become overcooked.

RBNZ didn't cease its about $55 billion large-scale asset programme until July 2021 and it continued its funding-for-lending programme (LSAP), which funneled more than $19 billion of cheap three-year funding, mostly to the major banks, through to December 2022.

According to Treasury, the LSAP is likely to cost the government more than $10 billion.

Hartwich notes that amount of money would pay for nearly four Dunedin hospitals.

The fact that central banks around the world were doing the same thing, printing money like there was no tomorrow, and that consequently inflation got out of hand globally doesn't excuse RBNZ's failings.

Agile and nimble?

Words such as “high-quality,” “successfully achieved” and making “a sound monetary policy decision” are sprinkled throughout this part of the report.

It also includes this gem: “the MPC engaged in agile and nimble decision-making in response to the pandemic.”

So nimble were the MPC's seven members through the pandemic that they first managed to “achieve” galloping inflation and then pushed the economy into an even worse recession than the GFC as they tried to bring inflation back under control.

Well, yes, it is back under control. But do we praise pyromaniacs for turning to fire fighting?

As Hartwich points out, this singularly depressing track record has also come at a time when RBNZ staff numbers have ballooned from between 200 and 250 through to 2017 to 601 with 91 jobs added in the latest year at a time when the government is trying to downsize the public service.

“The RBNZ managed the global financial crisis with far fewer senior positions,” Hartwich noted.

In 2017, 132 RBNZ employees earned more than $100,000. In the latest year, there were 436 staffers earning six figures.

I decided to apply my Fonterra spreadsheets to the RBNZ. In the year ended Jun 30, 2018 – so about three months after Orr become governor, those earning more than $100,000 cost RBNZ between $22.6 million and nearly $24 million. (Companies are required to report those earning over $100,000 in $10,000 bands.)

In the year ended June, 2024, these people cost RBNZ between $72.1 million and $76.5 million.

Thank you Jenny … Yes it is the worse we’ve had since the 90’s and the unicorns fairy dust and butterflies that the RBNZ keep dishing out is an insult … just drive through every small shopping area and count the closed shops …